Maharashtra’s pro-investor MPID Act intends to protect the interest of depositors belonging to the middle class and poor economic strata, the Bombay High Court has said while refusing to quash a special court order directing the graded distribution of funds in connection with a 2013 case related to an alleged scam at the National Spot Exchange Ltd.

A division bench, in its March 15 order, noted the intention of enacting the tough Maharashtra Protection of Interest of Depositors (in Financial Establishments) Act (MPID Act) was to protect the interest of depositors.

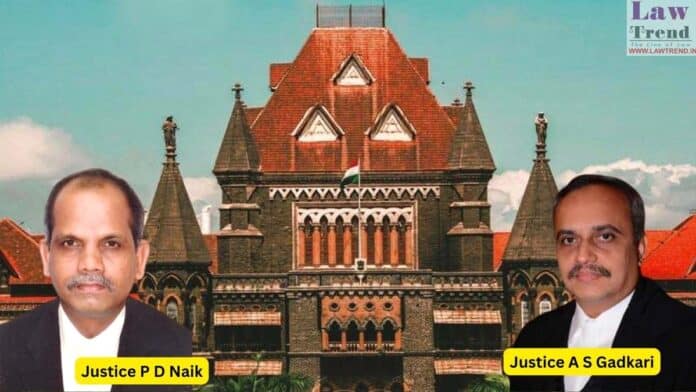

The bench of Justices A S Gadkari and P D Naik dismissed an appeal filed by the NSEL Investors Action Group challenging an order passed by a special court in October 2022 directing the Competent Authority to make a graded distribution to only individual investors/depositors who had outstanding amount between Rs 10 lakh to Rs 20 lakh from the available amount with it, after due verification.

The special court had passed the order on applications filed by two senior citizens who had outstanding dues from NSEL of around Rs 10 lakh each.

“According to this Court, such graded distribution of money to the individual investors in the range of Rs 10 lakh to Rs 20 lakh is certainly as per the principle of equity, in conformity with the intention of the legislature and the statement and object behind enacting the MPID Act,” said the bench.

The HC held that the class of individual investors/depositors to whom the outstanding amounts between Rs 10 lakh to Rs 20 lakh from the available amount with the Competent Authority as directed to be paid by the trial court, does not create further/separate classification of investors/depositors.

“In fact, it is in view of the intention of the legislature to protect the interest of depositors from the public, mostly middle class and poor economic strata of the society (through MPID Act) and not the corporate entities,” said the bench.

The court noted that there are approximately 2,040 individual investors who have a receivable outstanding in the range of Rs 10 lakh to Rs 20 lakh. The distribution of the amount received from the sale of attached properties has to be ‘equitable’.

The bench, while dismissing the appeal, said the special court has not committed any error, either in law or on facts, while passing the order.

The nearly ten-year-old case relates to the payment and settlement crisis in the spot commodity exchange. The Mumbai police had registered a case against the NSEL under the MPID Act on behalf of 11,000 investors to recover Rs 5,600 crore allegedly lost in the scam which came to light in July 2013.