The Delhi High Court has dismissed petitions by several home buyers seeking directions to banks and financial institutions to not charge EMIs till the real estate developers deliver the possession of their respective flats.

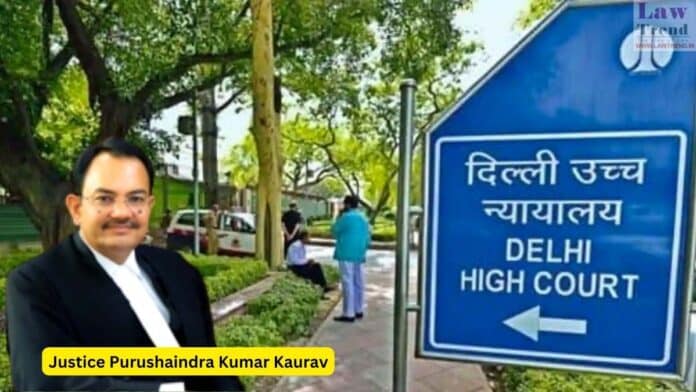

Justice Purushaindra Kumar Kaurav refused to entertain the writ petitions on the ground that the petitioners have alternative remedies under various laws such as the Consumer Protection Act, Insolvency and Bankruptcy Code and the Real Estate Regulation and Development Act.

Since the interest of a large number of home buyers is involved in these cases, if they avail the alternative remedies, the same may be considered and decided expeditiously in accordance with law, said the judge.

The petitioners before the court included Supertech Urban Home Buyers Association (SUHA) Foundation, consisting of 123 home buyers, and other similarly placed people who have taken home loans from banks and financial institutions on the basis of subvention scheme.

Under the scheme, the sanctioned loan amount was disbursed directly to the builder who was supposed to pay the pre-EMIs or full EMIs.

However, in the present case, the builders did not fulfil their obligation of delivering the possession as well as payment of EMIs but the banks demanded re-payment from the borrowers.

Justice Kaurav said the rights of the borrowers in the present case are mainly governed by the terms of the contract, and no order can be issued under writ proceedings under Article 226 of the Constitution to “compel the authorities to remedy a breach of contract”.

“A perusal of various clauses of respective agreements, be it ‘buyer-developer agreement’, ‘loan agreement’ or ‘tripartite agreement’, the rights claimed by the petitioners are eventually flowing from the respective agreements only. It is also to be noted that the violation of RBI Circulars has been alleged by the petitioners homebuyers, which is disputed by the respondents,” said the judge in his order dated March 14.

The court noted the cases before it are “purely contractual in nature” and some of the agreements in question even provide for arbitration between the parties, and proceedings before other tribunals in some instances are already pending.

“There are various statutes such as RERA Act, Consumer Protection Act, Insolvency and Bankruptcy Code, 2016, SARFAESI Act etc., where the petitioners can raise their grievances. It would not be advisable to entertain a writ petition under Article 226 of the Constitution under the facts of the present cases,” said the court.

“In the instant case, not only the rights of the petitioners are flowing from private contract but the complex and disputed question of facts are involved and the parties are not remediless. Alternative forums are already in place. Any interference by the writ court under the facts of the present case would amount to usurpation of powers vested with the respective forums,” it ruled.

The court clarified it has not expressed any opinion on the merits of the case and has also not given any finding with respect to the violations/non-violations on the part of the parties.

The central government argued that writ petition is a public law remedy and is not available in private disputes.

The petitioners had argued that more than 200 home buyers could not be left remediless and a subvention arrangement itself has been prohibited by the RBI and several builders are facing insolvency proceedings.

The petitioners claimed that RBI guidelines were not followed by the banks and urged the court to ensure that no recoveries are made from them and no coercive action is taken.