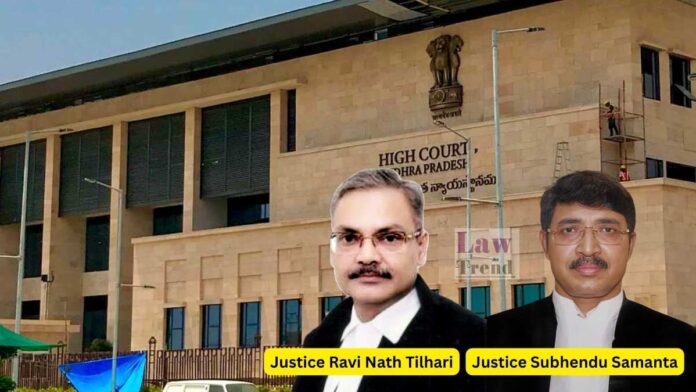

In a significant ruling concerning the rights of taxpayers to receive timely refunds, the Andhra Pradesh High Court has held that the Commercial Tax Department is liable to pay interest on delayed refunds if the amount is not actually credited to the dealer within the statutory period of 90 days. The Court clarified that mere

To Read More Please Subscribe to VIP Membership for Unlimited Access to All the Articles, Download Available Copies of Judgments/Order, Acess to Central/State Bare Acts, Advertisement Free Content, Access to More than 4000 Legal Drafts( Readymade Editable Formats of Suits, Petitions, Writs, Legal Notices, Divorce Petitions, 138 Notices, Bail Applications etc.) in Hindi and English.