The Delhi High Court on Monday will hear a petition challenging the inclusion of chartered accountants, company secretaries and cost accountants within the ambit of “reporting entities” under the anti-money laundering law and fastening of criminal liability on them in case of non-compliance of the legal provisions.

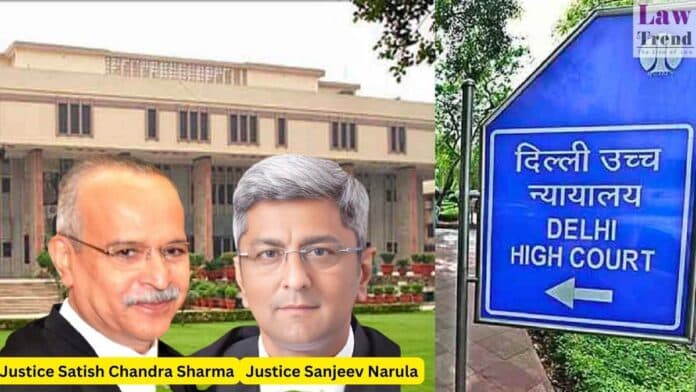

The petition by Rajat Mohan, a practising chartered accountant (CA), is listed for hearing before a bench of Chief Justice Satish Chandra Sharma and Justice Sanjeev Narula.

The plea said by including CAs and other professionals within the definition of “reporting entities” under the Prevention of Money Laundering Act (PMLA), “onerous obligations” have been put on them with consequences of noncompliance leading to criminal prosecution, and it virtually makes such professionals engage in “policing” their own clients with whom they interact in fiduciary capacity.

“The Petitioner by way of the present writ petition is challenging the validity of Gazette Notification No. S.O.2036(E) dated 03.05.2023 passed by the Respondents wherein they have read into the provisions of the Prevention of Money Laundering Act, 2002 and expanded the definition of the word person’ used in Section 2(1)(sa)(vi) as well as the definition of the word activity’ used in PMLA. Specifically, a class of professionals i.e., Chartered Accountants/Company Secretaries/Cost Accountants have been included within the definition of Reporting Entities’,” the petition filed through advocates Shweta Kapoor and R K Kapoor said.

The petition said the notification violates Articles 14, 19, 20 (3), 21 and 300A of the Constitution of India as well as other civil and statutory rights, including the right of privacy as well as the protection accorded to professional, privileged, and confidential communications.

It contended that the notification gives “unbridled and unlimited, arbitrary, and whimsical power” to the authority under the anti-money laundering law and creates the framework for a fishing and roving enquiry into every financial transaction of each individual/citizen of the country.

“The scope and application of PMLA is extremely rigorous and strict and even a bonafide oversight shall put the life, liberty, careers of the Reporting Entities under threat. A sword of Damocles would always remain hanging on the head of the petitioner,” the petition said.

“It is left to the knowledge, comprehension and thought process of each Chartered Accountant/Company Secretary/Cost Accountant to judge the clients coming to them to understand their transactions from the perspective of money laundering and then increase their vigil on those accounts. This is the function of the state as per law and not of ordinary citizens who are merely professionals in a particular field and not qualified prosecutors,” it further said.