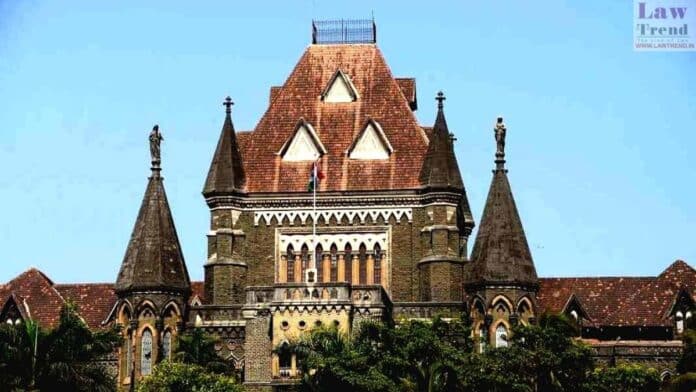

The Bombay High Court on Tuesday granted significant relief to the Board of Control for Cricket in India (BCCI) by setting aside a prior decision by the Income Tax Appellate Tribunal (ITAT) that supported the cancellation of its tax exemption. Justices MS Sonak and Jitendra Jain emphasized that tax authorities must adhere to due process in deciding the exemption issue independently, highlighting the need for consistent stances by the revenue authorities.

The BCCI, registered under the Tamil Nadu Societies Registration Act of 1975, primarily aims to promote sports, particularly cricket. It had been recognized as a charitable institution under the Income Tax Act in 1996, granting it certain tax benefits. Controversy arose following amendments to the BCCI’s memorandum of association in 2006 and 2007, which led the Director of Income Tax (Exemptions) to declare in 2009 that these changes rendered the 1996 exemption invalid from June 2006 onwards.

The BCCI challenged this interpretation by filing an appeal with the ITAT in 2010, which was dismissed, and subsequently pursued a writ petition in the high court. During the court proceedings, senior counsel PJ Pardiwalla argued on behalf of the BCCI that the amendments were minor and did not alter the organization’s fundamental charitable objectives. Furthermore, he contested the ITAT’s jurisdictional overreach concerning its comments on the BCCI’s operations, including references to the Indian Premier League (IPL).

On the other side, Advocate PC Chhotaray, representing the revenue, defended the ITAT’s rationale, insisting that the BCCI had failed to notify the tax authorities about the amendments, thereby shifting from a charitable to a commercial entity. However, the High Court found that the ITAT had indeed exceeded its authority by delving into the merits of the case when the appeal was declared non-maintainable.

The court clarified that the 2009 communication from the DIT was advisory in nature and did not constitute a formal cancellation of the BCCI’s tax-exempt status. As such, it ruled that this communication could not adversely affect the BCCI’s rights or lead to a cancellation of its registration.