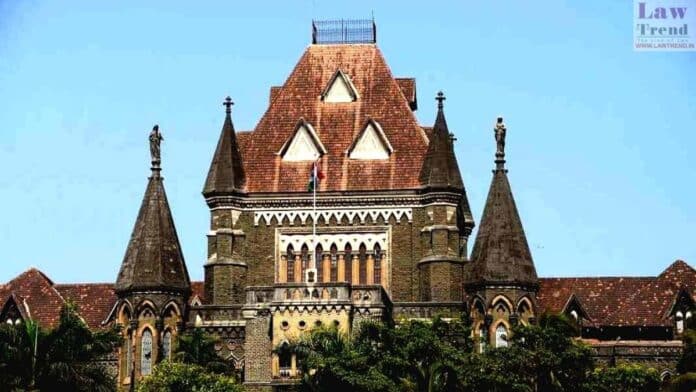

In a pivotal legal development, the Bombay High Court ruling in the case serves as a beacon of hope for taxpayers, reinforcing their rights against retroactive tax legislation. The case, centered around Sar Senapati Santaji Ghorpade Sugar Factory Ltd., sheds light on the complexities and challenges taxpayers face in navigating tax settlement procedures amidst legislative

To Read More Please Subscribe to VIP Membership for Unlimited Access to All the Articles, Download Available Copies of Judgments/Order, Acess to Central/State Bare Acts, Advertisement Free Content, Access to More than 4000 Legal Drafts( Readymade Editable Formats of Suits, Petitions, Writs, Legal Notices, Divorce Petitions, 138 Notices, Bail Applications etc.) in Hindi and English.