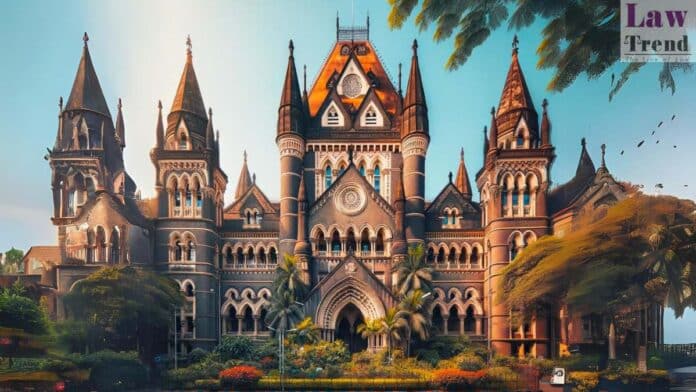

In a significant judgment delivered on August 23, 2024, a Full Bench of the Bombay High Court, comprising Justice A.S. Chandurkar, Justice Manish Pitale, and Justice Sandeep V. Marne, ruled that property owners and occupiers in Mumbai are liable to pay water tax and water benefit tax irrespective of whether they actually consume water. The

To Read More Please Subscribe to VIP Membership for Unlimited Access to All the Articles, Download Available Copies of Judgments/Order, Acess to Central/State Bare Acts, Advertisement Free Content, Access to More than 4000 Legal Drafts( Readymade Editable Formats of Suits, Petitions, Writs, Legal Notices, Divorce Petitions, 138 Notices, Bail Applications etc.) in Hindi and English.