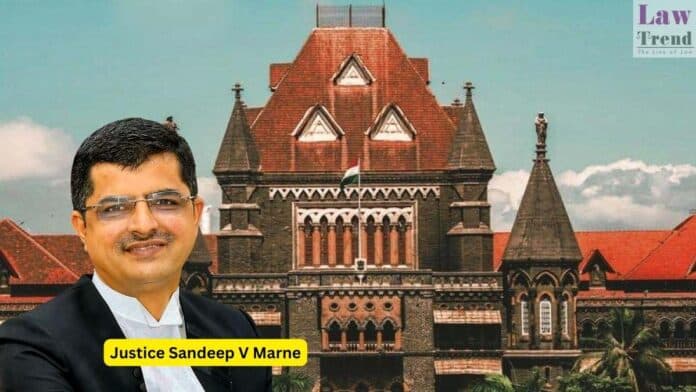

The Bombay High Court has upheld an Appellate Arbitral Award allowing a trader to retain profits of approximately Rs. 1.75 Crores earned from trades executed using erroneous margin credited due to a technical glitch in the broker’s system. Justice Sandeep V. Marne, while dismissing the petition filed by Kotak Securities Limited under Section 34 of

To Read More Please Subscribe to VIP Membership for Unlimited Access to All the Articles, Download Available Copies of Judgments/Order, Acess to Central/State Bare Acts, Advertisement Free Content, Access to More than 4000 Legal Drafts( Readymade Editable Formats of Suits, Petitions, Writs, Legal Notices, Divorce Petitions, 138 Notices, Bail Applications etc.) in Hindi and English.