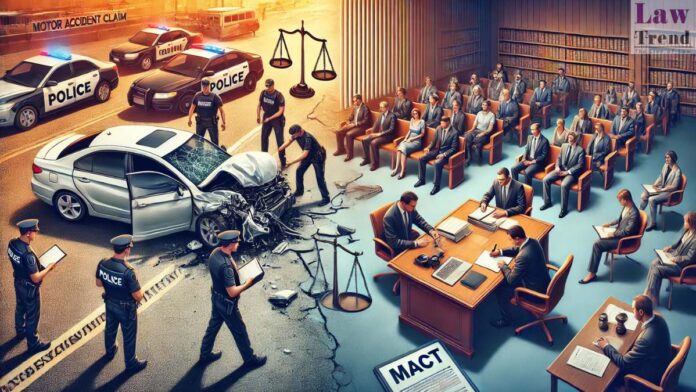

The Supreme Court of India delivered a landmark ruling emphasizing the inclusion of perquisites and allowances in calculating the compensation for motor accident claims. This judgment marks a significant shift in how compensation is assessed, particularly in cases involving salaried employees with diverse remuneration components. The apex court ruled that allowances such as house rent