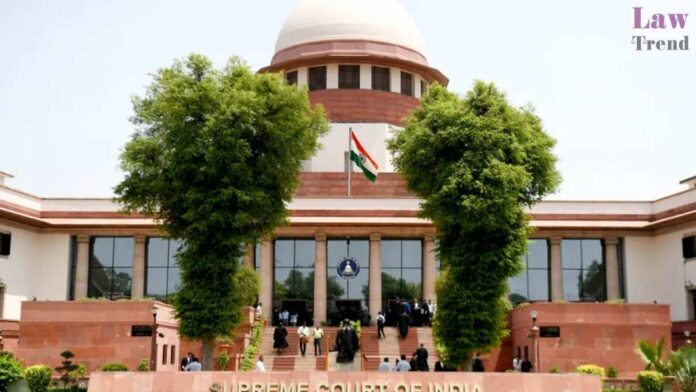

The Supreme Court of India, in the case of Commissioner of Service Tax v. M/s Elegant Developers, has dismissed appeals filed by the revenue, holding that a developer facilitating land acquisition for a “fixed average rate” while bearing the risk of profit or loss is not acting as a ‘Real Estate Agent’ and is not

To Read More Please Subscribe to VIP Membership for Unlimited Access to All the Articles, Download Available Copies of Judgments/Order, Acess to Central/State Bare Acts, Advertisement Free Content, Access to More than 4000 Legal Drafts( Readymade Editable Formats of Suits, Petitions, Writs, Legal Notices, Divorce Petitions, 138 Notices, Bail Applications etc.) in Hindi and English.