The Bombay High Court heard firm assertions from the Customs department on Thursday, stating that Skoda Auto Volkswagen India must adhere to the tax laws and cannot portray itself as a victim in the ongoing dispute over a USD 1.4 billion tax demand. The department accused the company of providing misleading information regarding its imports, a claim that has led to significant legal scrutiny.

Represented by Additional Solicitor General N Venkatraman, the Customs department argued that the automotive giant had misclassified its imports to reduce the payable duties. According to Venkatraman, Skoda Volkswagen misreported its imported Audi, Skoda, and Volkswagen cars as “individual parts” rather than “Completely Knocked Down” (CKD) units, thus paying far less in customs duties than required.

“You have to follow the law. You have to fall in line. The rule of law is the same for everyone. Similar importers are already paying 30 per cent,” Venkatraman emphasized in court. He pointed out that it is the company’s responsibility to classify the items correctly and that any failure to do so is not the fault of the customs department.

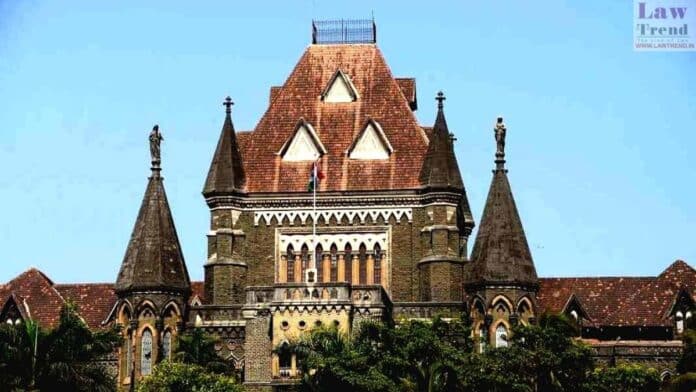

The legal battle intensified as Skoda Volkswagen challenged the tax demand notice, labeling it as “arbitrary and illegal” and describing the Rs 12,000 crore demand as “exorbitant.” The case is being heard by a division bench consisting of Justices B P Colabawalla and Firdosh Pooniwalla, with proceedings set to continue on Friday.

During the proceedings, the bench noted Volkswagen’s defense that it had consistently classified its imports as individual components and paid taxes accordingly. “Their argument is that once you (customs) have classified them under one category all these years, can you now re-classify them,” the bench pointed out. In response, Venkatraman suggested that reclassification was justified if new facts warranted such an action.

The ASG further revealed that the company had not been transparent in its operations. “Until now, no commissioner had an iota of (an idea of) what the company was doing all these years. How they were importing their material, how they were assembling it, no one in the world knew. Our investigation revealed the truth,” he said.

Previously, Venkatraman assured the court that no consignment from Skoda Auto Volkswagen India would be stopped in light of the tax demand, aiming to prevent any disruption in the company’s operations.