Enemy properties vested with government-appointed custodians are not assets of the central government which cannot seek exemption from paying municipal cess, including house and water taxes, the Supreme Court has held.

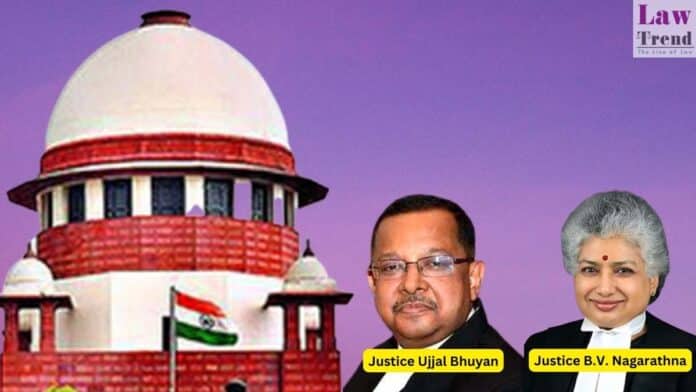

The verdict was delivered by a bench comprising Justices BV Nagarathna and Ujjal Bhuyan on Thursday on an appeal of the Lucknow Municipal Corporation against an Allahabad High Court judgment holding that the civic body cannot seek property taxes from the assessees who are in occupation of an enemy property.

The property in question is located on Mahatma Gandhi Marg in Lucknow and was once owned by the Raja’ of Mahmudabad, Mohammad Amir Ahmed Khan, who had migrated to Pakistan in 1947.

However, the son and wife of Khan remained in India and later sought its return after the death of the Raja’.

A portion of the property is currently occupied and used for “profit-generating purposes” by a respondent-assessee, Kohli Brothers Colour Lab Pvt Ltd who had contested the demand for house and other taxes by the civic body.

“The Union of India cannot assume ownership of the enemy properties once the said property is vested in the Custodian. This is because, there is no transfer of ownership from the owner of the enemy property to the Custodian and consequently, there is no ownership rights transferred to the Union of India. Therefore, the enemy properties which vest in the Custodian are not Union properties,” Justice Nagarathna, writing 143-page judgement, said.

“When the Custodian appointed by the Central Government in whom enemy property vests is only a trustee and does not adorn the status of an owner of such enemy property, consequently, the Central Government or the Union even within the meaning of Article 285 of the Constitution cannot usurp the ownership of such property,” it held.

It also held that the Custodian for Enemy Property in India’ does not acquire ownership of such assets which vest in it and the authority is “a trustee only for the management and administration of such properties”.

The bench ruled that vesting enemy property in the custodian is only a temporary measure and hence, the central government cannot claim exemption from civic taxes under Article 285 of the Constitution.

Article 285 reads : “The property of the Union shall, save in so far as Parliament may by law otherwise provide, be exempt from all taxes imposed by a State or by any authority within a State”.

“As the enemy properties are not Union properties, clause (1) of Article 285 does not apply to enemy properties..,” the top court held.

The top court set aside the high court verdict, saying it was not right in holding that the respondent (Kohli Brothers Colour Lab Pvt Ltd), one of the occupiers of the enemy property, was not liable to pay any property tax or other local taxes to the appellant.

Also Read

The verdict said the amount already paid as taxes to the civic body shall not be refunded.

“However, if no demand notices have been issued till date, the same shall not be issued but from the current fiscal year onwards (2024-2025), the appellant shall be entitled to levy and collect the property tax as well as water tax and sewerage charges and any other local taxes in accordance with law,” the bench said while allowing the appeal of the Lucknow Municipal Corporation.

The bench also dealt with the question whether statutory vesting of assets termed as enemy property under the provisions of the Enemy Property Act, 1968 amounted to expropriation leading to change of its status with regard to the ownership.

“We emphasise again that mere vesting of enemy property in the Custodian does not transfer ownership of the same from the enemy to the Union or to the Central Government; the ownership remains with the enemy but the Custodian only protects and manages the enemy property and in discharging his duties as the Custodian or the protector of enemy property he acts in accordance with the provision of the Act and on the instructions or guidance of the Central Government…,” it said.