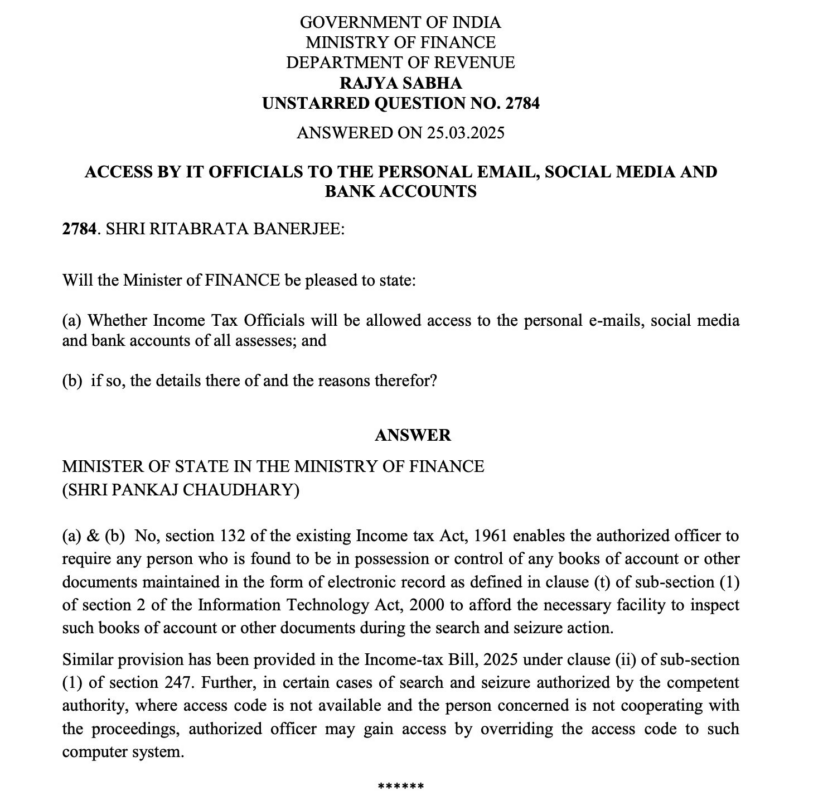

In response to a query raised in the Rajya Sabha, the Government of India has clarified that Income Tax officials are not allowed unrestricted access to personal emails, social media, or bank accounts of individuals. The assurance came in a written reply by Shri Pankaj Chaudhary, Minister of State in the Ministry of Finance, to Unstarred Question No. 2784 posed by MP Shri Ritabrata Banerjee.

The Minister stated that Section 132 of the Income Tax Act, 1961 authorizes officials to inspect books of account or documents maintained in electronic form, but only during search and seizure operations. This is in line with Clause (t) of Sub-section (1) of Section 2 of the Information Technology Act, 2000. Officials can demand access to digital records during such operations if they are in possession or control of the person being investigated.

The new Income Tax Bill, 2025, includes a similar provision under Clause (ii) of Sub-section (1) of Section 247. Notably, in situations where the person under investigation does not cooperate and access codes to electronic devices are unavailable, authorized officers may override these codes to gain access, but only under proper authorization.

Thus, while Income Tax officials cannot freely access social media accounts or emails, they may do so in specific, legally sanctioned circumstances during search and seizure actions.