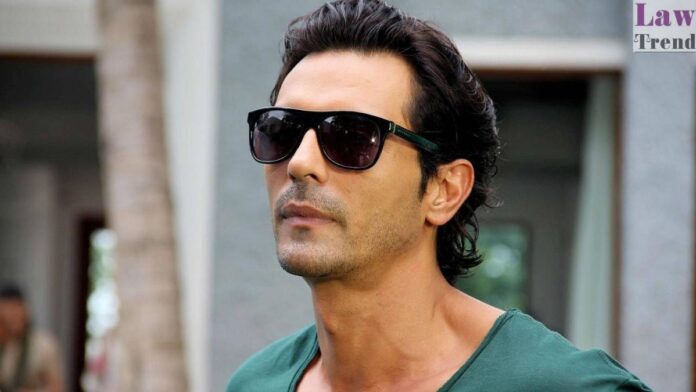

The Bombay High Court has quashed a non-bailable warrant issued against actor Arjun Rampal in a 2019 tax evasion case, observing that the order passed by a magistrate’s court was “mechanical,” “cryptic,” and contrary to law.

Justice Advait Sethna, presiding over a vacation bench, delivered the ruling on May 16 in response to a petition filed by Rampal challenging the warrant issued on April 9 this year. The warrant was related to a 2019 complaint filed by the Income Tax Department alleging willful tax default under Section 276C(2) of the Income Tax Act — a bailable offence that carries a maximum punishment of three years.

According to Rampal’s petition, his legal counsel had sought an exemption from personal appearance on the day in question, but the magistrate’s court dismissed the request and issued the non-bailable warrant. The High Court sharply criticized the manner in which the magistrate proceeded.

“The magistrate’s court has not considered that the offence alleged is bailable and has mechanically passed the order,” Justice Sethna said. “The order is cryptic and lacks application of mind.” He further noted that no specific reasons were recorded before issuing the warrant, which violated basic legal principles.

The High Court observed that such an order could cause unwarranted prejudice to the actor, especially since his counsel was present in court at the time of the proceedings.

Rampal had also contested a December 2019 order from the magistrate’s court which had initially issued notice to him in the case. Both the 2019 notice and the 2025 warrant, his counsel argued, were passed arbitrarily and without proper judicial reasoning.

Representing Rampal, advocate Swapnil Ambure contended that the actor had paid the entire tax amount for the financial year 2016–17, albeit with delay. “There is no tax evasion as alleged. The department’s complaint is misconceived,” Ambure told the High Court.

He further argued that issuing a non-bailable warrant in a bailable offence violated the settled principles laid down by the Supreme Court, which discourage courts from resorting to coercive measures unless strictly necessary.

The High Court has posted the matter for further hearing on June 16.