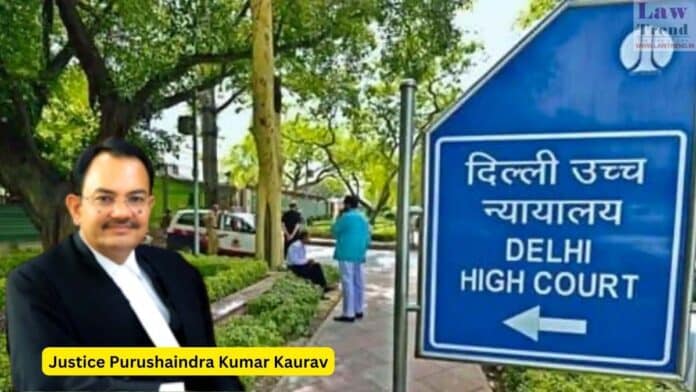

In a significant judgment delivered on December 24, 2024, Justice Purushaindra Kumar Kaurav of the Delhi High Court provided a detailed analysis of the legal distinction between ancestral and inherited property. This ruling came in the case of Birbal Saini v. Satywati (RSA 196/2019), which involved a dispute over property ownership within a family. The

To Read More Please Subscribe to VIP Membership for Unlimited Access to All the Articles, Download Available Copies of Judgments/Order, Acess to Central/State Bare Acts, Advertisement Free Content, Access to More than 4000 Legal Drafts( Readymade Editable Formats of Suits, Petitions, Writs, Legal Notices, Divorce Petitions, 138 Notices, Bail Applications etc.) in Hindi and English.