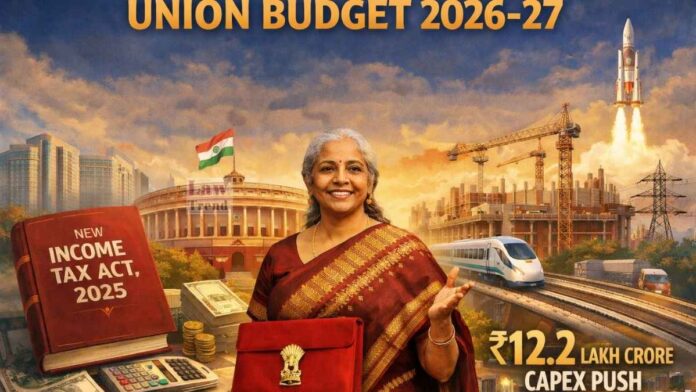

Union Finance Minister Nirmala Sitharaman presented the Union Budget for the fiscal year 2026-2027 in Parliament today, marking a significant legislative push towards the government’s vision of a “Viksit Bharat” (Developed India). In a speech that balanced fiscal consolidation with aggressive capital expenditure, the Finance Minister introduced the new Income Tax Act, 2025, which will replace the existing 1961 legislation starting April 1, 2026.

Stability Amidst Global Volatility

The Finance Minister began by highlighting the government’s 12-year tenure, characterizing the economic trajectory as one marked by “stability, fiscal discipline, sustained growth and moderate inflation”. She noted that these outcomes were the result of “conscious choices” made despite global uncertainty.

Acknowledging the challenging external environment where “trade and multilateralism are imperilled,” the Minister emphasized that India must remain integrated with global markets while building domestic capacity. The Budget is anchored in the “3 Kartavya” (Duties): accelerating economic growth, fulfilling aspirations, and ensuring Sabka Sath, Sabka Vikas.

The Three Kartavyas: Proposals and Arguments

The Budget proposals were categorized under three distinct duties (“Kartavyas”) aimed at different segments of the economy and society.

1. First Kartavya: Economic Growth and Manufacturing

To accelerate growth, the government proposed interventions in seven strategic sectors:

- Biopharma Shakti: A new strategy with an outlay of ₹10,000 crore over 5 years was proposed to develop India as a global biopharma hub. This includes upgrading 7 National Institutes of Pharmaceutical Education and Research (NIPER) and creating a network of 1,000 clinical trial sites.

- Semiconductors & Electronics: Building on the India Semiconductor Mission (ISM) 1.0, the government will launch ISM 2.0 to focus on equipment, materials, and full-stack Indian IP. The outlay for the Electronics Components Manufacturing Scheme is proposed to be increased to ₹40,000 crore.

- Rare Earth Corridors: Dedicated corridors will be established in Odisha, Kerala, Andhra Pradesh, and Tamil Nadu to promote mining and processing of rare earth minerals.

- Infrastructure Push: The capital expenditure (Capex) target has been increased to ₹12.2 lakh crore for FY 2026-27, up from ₹11.2 lakh crore in the previous year.

- Waterways: 20 new National Waterways will be operationalized, starting with NW-5 in Odisha.

- High-Speed Rail: Seven new corridors were announced, including Mumbai-Pune, Delhi-Varanasi, and Hyderabad-Bengaluru.

- City Economic Regions: A “City Economic Regions” (CER) initiative was proposed with an allocation of ₹5,000 crore per CER to develop economic agglomerations in Tier-2 and Tier-3 cities.

2. Second Kartavya: Aspirations and Capacity Building

Focusing on the youth and services sector, the FM proposed:

- Healthcare Skilling: A plan to add 100,000 Allied Health Professionals (AHPs) over 5 years and train 1.5 lakh caregivers.

- Education: Establishment of 5 “University Townships” near industrial corridors and a new National Institute of Design in the eastern region.

- Tourism: Development of ecological trails (mountain, turtle, and bird watching) and a “National Destination Digital Knowledge Grid” to document cultural sites.

3. Third Kartavya: Sabka Sath, Sabka Vikas

- Agriculture: A “Coconut Promotion Scheme” and a dedicated program for cashew and cocoa were proposed to boost coastal economies. A new AI tool, Bharat-VISTAAR, will be launched to provide customized advisory support to farmers.

- Women Entrepreneurship: Transitioning from “Lakhpati Didis” to enterprise owners, the government will set up “SHE-Marts”—community-owned retail outlets.

- Divyangjan: A “Divyang Sahara Yojana” will be introduced to support the manufacturing of assistive devices and set up “Assistive Technology Marts”.

Fiscal Management and Taxation

Fiscal Consolidation

The Finance Minister reiterated the government’s commitment to fiscal prudence.

- Fiscal Deficit: The deficit for RE 2025-26 is estimated at 4.4% of GDP. For BE 2026-27, the target is set at 4.3% of GDP.

- Debt-to-GDP: The ratio is estimated to decline to 55.6% in BE 2026-27.

Part B: Direct Tax Proposals

The most significant announcement was the replacement of the Income Tax Act, 1961.

- New Income Tax Act, 2025: The new Act will come into effect from April 1, 2026. The rules and forms will be notified shortly to allow taxpayers time to adapt.

- TCS Rationalization:

- The Tax Collected at Source (TCS) rate for overseas tour packages is proposed to be reduced to 2% (from 5% and 20%) without any amount stipulation.

- TCS for education and medical purposes under LRS is reduced from 5% to 2%.

- Capital Gains on Buyback: To prevent tax arbitrage, share buybacks will now be taxed as Capital Gains in the hands of the shareholder. Promoters will pay an additional buyback tax to equalize the effective tax rate.

- Securities Transaction Tax (STT):

- STT on Futures raised to 0.05% (from 0.02%).

- STT on Options raised to 0.15% (from 0.1%).

- Ease of Living Measures:

- Interest awarded by the Motor Accident Claims Tribunal (MACT) is now exempt from income tax.

- A one-time Foreign Asset Disclosure Scheme was proposed for small taxpayers to disclose undeclared overseas assets up to ₹1 crore (with 30% tax + 30% penalty) or ₹5 crore (with ₹1 lakh fee) to avoid prosecution.

Part B: Indirect Tax Proposals

- Customs Duty Reductions:

- Cancer Drugs: Basic customs duty on 17 specific cancer drugs and medicines is reduced to Nil.

- Mobile/Electronics: Duty on specified parts for microwave ovens and mobile phone manufacturing is reduced to Nil.

- Personal Imports: The tariff rate on goods imported for personal use is reduced from 20% to 10%.

- Solar & Energy: Duty exemption on capital goods for Lithium-Ion cells is extended to battery energy storage systems.

The Finance Minister concluded the speech by commending the Finance Bill, 2026, to the House. The proposed changes in direct taxes, including the new Income Tax Act, are slated to be effective from April 1, 2026, while customs duty changes generally take effect from February 2, 2026.