A same-sex couple has approached the Bombay High Court challenging the Income Tax Act’s provisions on gift taxation, alleging that the law unfairly excludes them from benefits available to heterosexual couples.

The plea contests the constitutional validity of the explanation to the fifth proviso of Section 56(2)(x) of the Income Tax Act, which exempts gifts received from “relatives” including “spouses” from being taxed as income. Since the Act does not explicitly define the term spouse, the petitioners argued that same-sex partners in long-term, stable relationships are left out of the exemption.

Under Section 56(2)(x), any sum of money, property, or asset received without adequate consideration and valued over ₹50,000 is treated as “income from other sources” and taxed accordingly. However, the proviso excludes gifts from specified relatives, including spouses, thereby creating, according to the petitioners, a discriminatory gap.

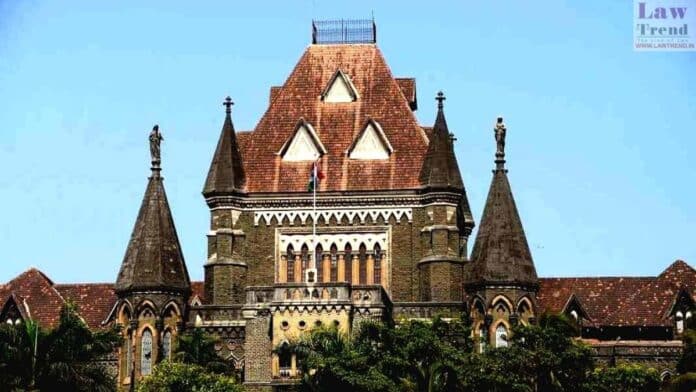

A bench of Justices B.P. Colabawalla and Firdosh Pooniwalla, while noting that the plea raises a question of constitutional validity, on August 14 issued notice to the Attorney General of India. The matter has been listed for further hearing on September 18.

The petitioners have sought a declaration that the word spouse in the Income Tax Act must be read to include same-sex partners, extending the benefit of tax exemption to them. They contended that stable same-sex relationships are in every material respect akin to heterosexual marriages and should be accorded equal treatment under the law.

The case marks another significant step in the continuing legal struggle for LGBTQ+ equality in India, following the Supreme Court’s decriminalisation of consensual same-sex relations in 2018 and the ongoing debates around marriage equality.