New Delhi – In a landmark meeting, the Goods and Services Tax (GST) Council has approved a series of sweeping reforms, including a major rate rationalization that promises to reduce the tax burden on a host of common consumer goods and services. The 56th GST Council meeting, chaired by Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman, introduced a simplified two-rate tax structure and announced significant GST cuts on items ranging from daily essentials and food products to small cars and life insurance, aiming to ease the cost of living for the common citizen and enhance the ease of doing business.

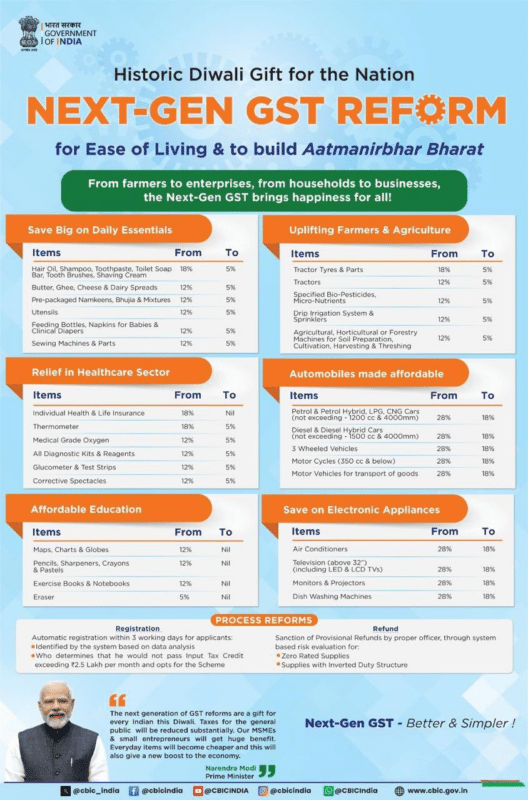

The 56th meeting of the GST Council was convened in New Delhi with a focus on implementing “next-generation GST reforms,” a vision articulated by Prime Minister Shri Narendra Modi. The stated objective of the Council was to evolve the landmark tax framework into a more “strategic, principled, and citizen-centric” system. The recommendations reflect a multi-sectoral approach, targeting relief for the common man, farmers, and key industries while correcting long-standing duty structures.

Key Recommendations of the Council

The Council’s decisions centered on a significant overhaul of the existing GST rate structure and providing targeted relief across various sectors.

1. A New ‘Simple Tax’ Structure: The most prominent reform is the rationalization of the current four-tiered GST structure into a two-rate system. The new framework will feature:

- A Standard Rate of 18%.

- A Merit Rate of 5% for essential goods.

- A special de-merit rate of 40% for a select few goods and services.

2. Widespread Rate Reductions for Consumers: The Council approved a substantial reduction in GST rates on numerous items of daily use.

- From 18% or 12% to 5%: The tax on common household articles such as hair oil, toilet soap bars, shampoos, toothbrushes, toothpaste, bicycles, tableware, and kitchenware has been slashed.

- Food Items: GST has been reduced from 12% or 18% to 5% on a wide array of food products including packaged namkeens, bhujia, sauces, pasta, instant noodles, chocolates, coffee, preserved meat, cornflakes, butter, and ghee.

- NIL Rate: Ultra-High Temperature (UHT) milk and pre-packaged paneer will now attract zero GST, down from 5%. Similarly, all Indian breads, including chapati, roti, and paratha, will be tax-free.

3. Relief in Insurance and Healthcare: In a significant move to make insurance more affordable and increase coverage, the Council has exempted GST on all individual life insurance policies (term, ULIP, endowment) and individual health insurance policies, including family floater and senior citizen plans. Furthermore, GST on 36 lifesaving drugs has been reduced to NIL, and the rate for all other drugs and medicines has been brought down from 12% to 5%.

4. Boost for Automotive and Other Key Sectors:

- Automobiles: The GST on small cars and motorcycles (equal to or less than 350cc) has been reduced from 28% to 18%. The rate for buses, trucks, ambulances, and three-wheelers has also been brought down to 18%, with a uniform 18% rate now applicable to all auto parts.

- Cement: The rate on cement, a key component in the construction sector, has been cut from 28% to 18%.

- Agriculture: To support the farming community, GST on tractors and various agricultural machinery has been reduced from 12% to 5%.

5. Correction of Inverted Duty Structure: The Council addressed the issue of inverted duty structure in the man-made textile sector by reducing the GST rate on man-made fibre from 18% to 5% and on man-made yarn from 12% to 5%. Similar corrections were made in the fertilizer sector.

Implementation and Other Measures

The Council has recommended that the changes in GST rates for services be implemented from September 22, 2025, with changes for most goods also effective from the same date. However, products like pan masala, gutkha, and cigarettes will continue under the existing rates until compensation cess obligations are fulfilled.

Additionally, the Council announced that the Goods and Services Tax Appellate Tribunal (GSTAT) will be made operational for accepting appeals by the end of September this year and will commence hearings before the end of December. This is a significant step towards strengthening the dispute resolution mechanism under the GST regime. The Principal Bench of the GSTAT will also function as the National Appellate Authority for Advance Ruling, ensuring more consistency and certainty for taxpayers.