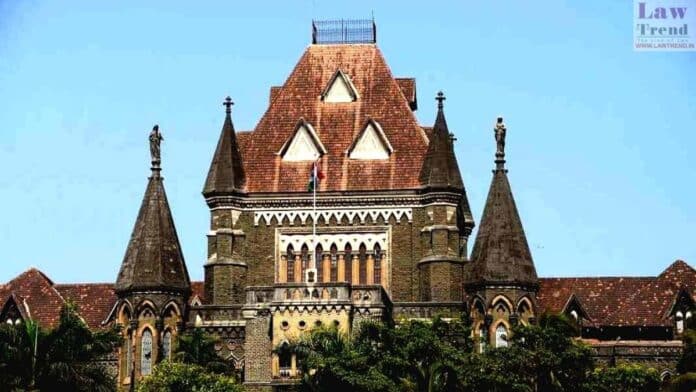

In a landmark judgment, the Bombay High Court has declared that health insurance payouts, including Mediclaim, should not be deducted from the compensation awarded to accident victims. This decision was delivered by a three-judge bench consisting of Justice A.S. Chandurkar, Justice Milind Jadhav, and Justice Gauri Godse, resolving a contentious issue that had seen divergent decisions in lower courts.

The case reached the three-judge panel following a challenge by New India Assurance Company Ltd against an Accident Claims Tribunal, Mumbai decision. The insurance company had argued for deducting the Mediclaim amount received by the accident victim from the total compensation for medical expenses, a stance opposed by the claimants.

Citing various Supreme Court precedents, the bench emphasized that the receipt of an insurance payout is a result of the contractual relationship between the insured and the insurer and is based on the premiums paid by the insured. “The beneficial amount would accrue to the share of the deceased either on maturity of the policy or on death, whatever be the manner of death. The tortfeasor [wrongdoer – in this case, the vehicle owner involved in the accident or his insurer] cannot take advantage of the foresight and wise financial investments made by the deceased,” the bench noted in its ruling.

This reference to a larger bench was prompted by contradictory judgments found in the appeal handled by a single judge bench of the high court. During the proceedings, differing interpretations from past judgments in similar cases—namely the Dineshchandra Shah case of 2013 and the Vrajesh Desai case of 2006—were debated.

With this ruling, the Bombay High Court has clarified that amounts received under a Mediclaim or health insurance policy for medical expenses incurred due to an accident must not reduce the compensation awarded to the victim under the Motor Vehicles Act.