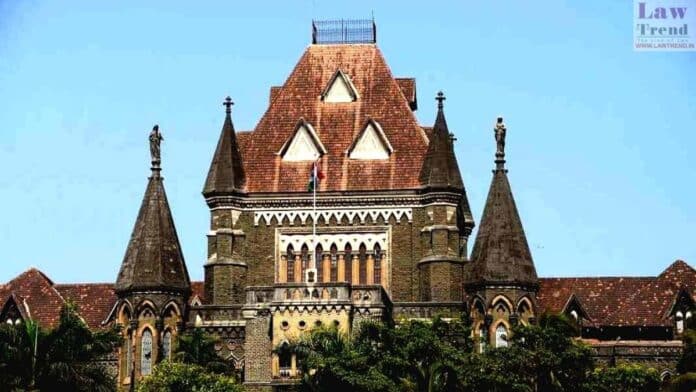

The Bombay High Court on Monday delved into the complex tax dispute involving Skoda Auto Volkswagen India, with the Customs Department assuring that no consignment of the automobile giant would be halted despite a pending USD 1.4 billion tax demand. This demand stems from a September 2024 show cause notice that challenges the company’s import practices.

Justices B P Colabawalla and Firdosh Pooniwalla presided over the session, setting February 20 for the continuation of the hearing. The dispute centers on whether the German firm improperly imported car parts as individual components instead of as “completely knocked down” (CKD) units, which are subject to higher duties.

During the proceedings, Justice Colabawalla highlighted potential loopholes in the firm’s practices, questioning whether importing all car components except one—like a gearbox—could still qualify the imports as individual parts, thereby attracting lower duties.

Additional Solicitor General N Venkatraman, representing the Customs Department, clarified to the court that no shipments have been stopped to date and assured continuity in this practice. This statement was accepted by the bench without contest.

Senior counsel Arvind Datar, arguing on behalf of Skoda Auto Volkswagen, pushed for the dismissal of the show cause notice, labeling it as illegal and arbitrary. Datar defended the company’s long-standing practice of importing individual car parts, a method used since 2001, and contested the sudden shift in the Customs Department’s stance in 2024. He argued that the company had been compliant with tax payments on individual parts from 2011 to 2024 without any objections from customs authorities.

The heart of the legal battle is a reclassification by customs in 2024, where imports previously deemed as individual parts were suddenly categorized under CKD, significantly raising potential duties owed. Datar emphasized the abrupt nature of this reclassification and the lack of consistency in customs enforcement over the years.

The case highlights ongoing tensions between large multinational corporations and tax authorities, revolving around the interpretation and application of customs duties on imported goods. Skoda Auto Volkswagen is accused of deliberately misclassifying its imports to reduce the payable duties, a claim that the company denies, pointing to a long history of compliance under the established classification.