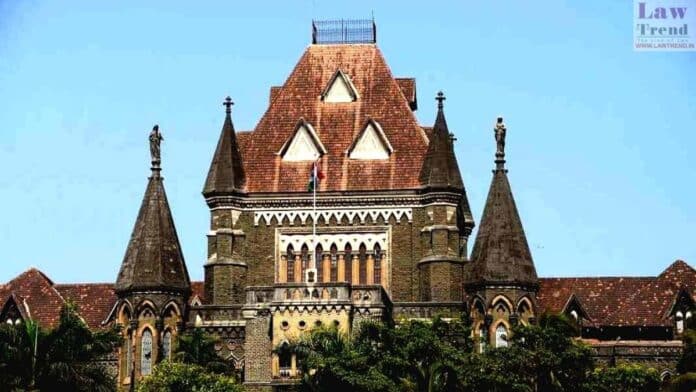

In a recent directive, the Bombay High Court has issued a cautionary advisory to banks and financial institutions, emphasizing the importance of rational and thoughtful decision-making before labeling any individual or entity as a wilful defaulter. The advice comes in light of adhering to the primary circulars issued by the Reserve Bank of India (RBI), ensuring that due process and careful consideration precede such significant declarations.

The bench, comprising Justices B P Colabawalla and Somashekhar Sundaresan, made this observation on March 4th, stressing that wilful defaulters are essentially barred from accessing financial services, which necessitates the use of discretion granted to banks under RBI guidelines with utmost responsibility.

The courts’ guidance was articulated during the hearing of a petition filed by Milind Patel, former Joint Managing Director of IL&FS Financial Services Ltd. (IFIN), challenging an order passed by Union Bank of India in February 2023. The order in question had declared the company and its promoters as wilful defaulters in accordance with the 2015 RBI circular.

Also Read

RBI’s circular mandates banks/financial institutions to quarterly report the data of wilful defaulters, which is also shared with the Securities and Exchange Board of India (SEBI). A wilful defaulter is defined as a borrower who intentionally refuses to repay the loan despite having the means to do so, as opposed to a defaulter who is unable to meet their loan obligations due to financial hardships.