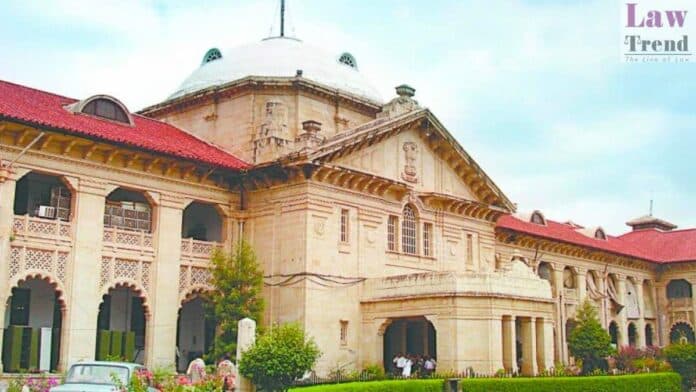

In a crucial ruling, the Allahabad High Court has quashed an order rejecting a stamp duty refund, holding that a retrospective amendment imposing a limitation period cannot extinguish an accrued right. The Division Bench comprising Justice Shekhar B. Saraf and Justice Vipin Chandra Dixit delivered the judgment in Writ-C No. 39180 of 2024 (Seema Padalia

To Read More Please Subscribe to VIP Membership for Unlimited Access to All the Articles, Download Available Copies of Judgments/Order, Acess to Central/State Bare Acts, Advertisement Free Content, Access to More than 4000 Legal Drafts( Readymade Editable Formats of Suits, Petitions, Writs, Legal Notices, Divorce Petitions, 138 Notices, Bail Applications etc.) in Hindi and English.