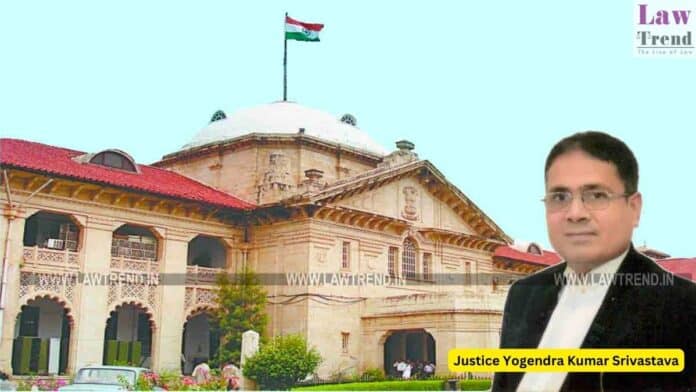

The Allahabad High Court has reiterated that mutation proceedings under the Uttar Pradesh Revenue Code, 2006 are summary in nature and strictly for fiscal purposes, deciding neither title nor ownership. The Court dismissed a writ petition challenging mutation orders, ruling that the extraordinary jurisdiction under Article 226 of the Constitution cannot be invoked in such

To Read More Please Subscribe to VIP Membership for Unlimited Access to All the Articles, Download Available Copies of Judgments/Order, Acess to Central/State Bare Acts, Advertisement Free Content, Access to More than 4000 Legal Drafts( Readymade Editable Formats of Suits, Petitions, Writs, Legal Notices, Divorce Petitions, 138 Notices, Bail Applications etc.) in Hindi and English.