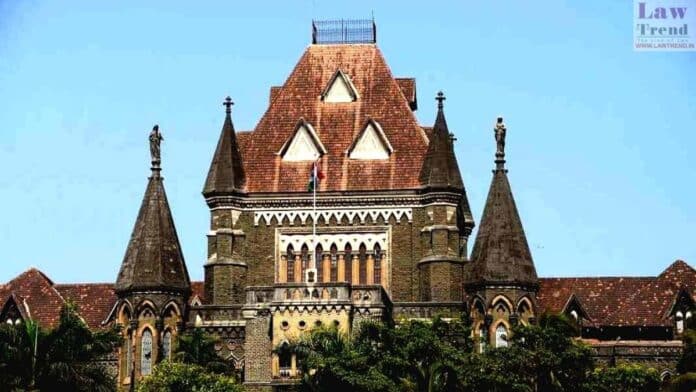

The Bombay High Court has set aside an income tax assessment order after finding that the assessing officer relied on non-existent, AI-generated case laws to justify additions to a company’s declared income.

A division bench of Justices B.P. Colabawalla and Amit B. Jamsandekar observed that while artificial intelligence can aid research, quasi-judicial authorities cannot blindly depend on AI outputs without verifying their authenticity.

“In this era of artificial intelligence (AI), one tends to place much reliance on the results thrown open by the system,” the bench said. “When one is exercising quasi-judicial functions, such results are not to be blindly relied upon but should be duly cross-verified before using them. Otherwise, mistakes like the present one creep in.”

The court made these remarks while quashing the assessment order and demand notice passed in March 2025 against KMG Wires Pvt Ltd by the National Faceless Assessment Centre (NFAC).

According to the order, the NFAC had assessed the total income of the company at ₹27.91 crore, as against ₹3.09 crore declared in its return. The company challenged both the assessment and the consequent demand notice before the High Court.

The bench noted that the assessment order was passed in violation of the principles of natural justice, as it ignored the company’s detailed reply to the show-cause notice.

Significantly, while computing the peak balance, the assessing authority relied on certain judicial precedents which, upon scrutiny, were found to be non-existent and AI-generated.

Holding that such reliance was impermissible, the court quashed the order and remanded the matter to the assessing officer for a fresh hearing in accordance with law.

The judgment serves as a cautionary reminder for tax officials and quasi-judicial authorities to exercise diligence when using AI tools in decision-making, ensuring that references to case laws and precedents are genuine and verifiable.