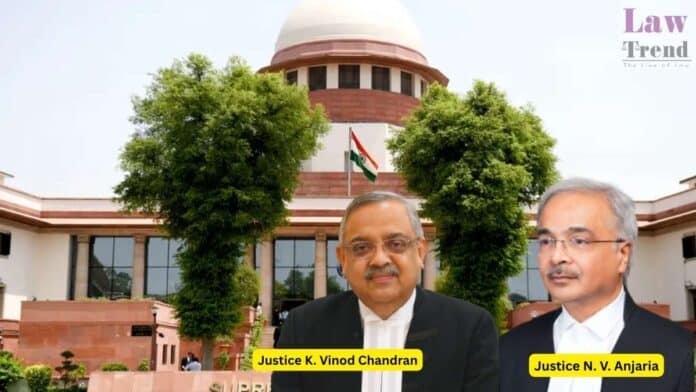

New Delhi: The Supreme Court of India, in a significant ruling on motor accident compensation, has enhanced the award for a student who was rendered paraplegic, holding that his notional income should be based on reasonable earning potential rather than the minimum wage applicable to a skilled worker. A bench of Justice K. Vinod Chandran

To Read More Please Subscribe to VIP Membership for Unlimited Access to All the Articles, Download Available Copies of Judgments/Order, Acess to Central/State Bare Acts, Advertisement Free Content, Access to More than 4000 Legal Drafts( Readymade Editable Formats of Suits, Petitions, Writs, Legal Notices, Divorce Petitions, 138 Notices, Bail Applications etc.) in Hindi and English.