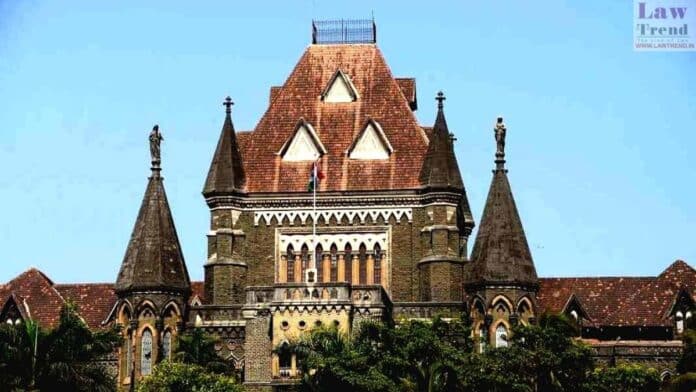

In a scathing indictment of bureaucratic apathy, the Bombay High Court on Monday imposed a compensation of ₹10,000 each on five government and statutory authorities, including the Unique Identification Authority of India (UIDAI), for failing to act on a citizen’s repeated pleas after his identity was misused to float a shell company in Gujarat.

A division bench of Justices M.S. Sonak and Jitendra Jain pulled up UIDAI, the Gujarat Chief Commissioner, the Chief Commissioner of Income Tax (Mumbai), the Union Bank of India, and the Gujarat Commissioner of State Tax, calling it a “very sad state of affairs” that these institutions remained “motionless” for over five years.

The case involves Vilas Prabhakar Lad, a 51-year-old shopkeeper from Mumbai, who found himself embroiled in legal trouble in 2019 after receiving a rent default notice for a property in Rajkot, Gujarat. The notice named him as associated with a company called Metro International Trading—a firm he had no knowledge of.

Lad approached the Dadar police in January 2020 and discovered that his identity had been fraudulently used by unknown individuals to set up the shell firm. Despite reporting the misuse to UIDAI and Goods and Services Tax (GST) authorities and requesting deactivation of the fraudulent Aadhaar and GST numbers issued in his name, no timely action was taken.

In a disturbing twist, Lad later learned that Andhra Bank (now merged with Union Bank of India) had opened an account under the shell company’s name using his original documents but with a different photograph. Yet again, no criminal proceedings were initiated.

Representing Lad, Advocate Uday Warunjikar argued that the authorities failed in their duty to protect confidential identity information and sought compensation and criminal action against the fraudsters. UIDAI’s counsel contended that they had deactivated the Aadhaar number but placed the blame on the bank for failing to authenticate the documents properly.

The court, however, was unconvinced. It remarked that despite clear red flags, no FIR was filed nor were any criminal proceedings initiated against the perpetrators. “There has been a total failure on the part of the authorities,” the bench said.

The High Court directed the GST department to delete Lad’s Aadhaar and PAN numbers from their database and ordered each of the five named authorities to pay ₹10,000 as compensation to Lad for their “dereliction of duty.”