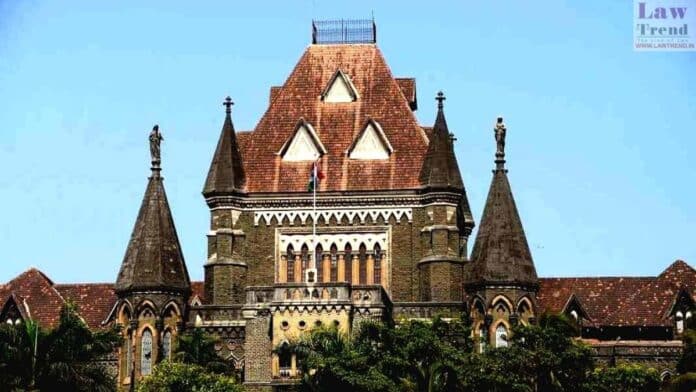

The Bombay High Court on Monday articulated its preliminary dissatisfaction with the arguments presented by Skoda Auto Volkswagen India against a $1.4 billion customs duty demand. The bench, comprising Justices B P Colabawalla and Firdosh Pooniwalla, praised the efforts of a Customs department officer for his meticulous research and dedication in issuing the notice.

The controversy centers on the accusation that the German automotive group, led by Skoda Auto Volkswagen India, misclassified its imports. According to the Customs department, the company declared Audi, Skoda, and Volkswagen cars as “individual parts” rather than “Completely Knocked Down” (CKD) units, resulting in significantly reduced customs duties. While CKD units typically attract a 30-35 percent duty, Volkswagen reportedly paid only 5-15 percent by declaring the imports as separate components across different shipments.

Justice Colabawalla highlighted the diligent work of the Customs officer involved, noting that he meticulously verified each part’s unique identification number, or KEN number, which is crucial for tracking automotive components. The court observed that if nearly all parts except one or two are imported as individual components and assembled at Volkswagen’s Aurangabad unit, it raises questions about whether these should be classified under the CKD category.

The High Court’s discussion also touched on the nature of the imports, suggesting that they essentially constituted a “completely built up” (CBU) model, albeit in an unassembled form. This distinction is critical because, unlike CBUs that are drivable upon clearance, these unassembled parts are transported to a facility for assembly using basic tools.

The legal proceedings stem from a customs notice issued in September 2024, which the company has contested as “exorbitant,” “arbitrary and illegal.” The company’s counsel, Arvind Datar, argued that the imports were correctly classified under the provisions of a 2011 notification that imposed a 30-35 percent tax on CKD models, asserting that the company paid taxes based on its classification of importing individual parts.

The High Court countered this argument by emphasizing the importance of the 2011 notification, which delineates tax categories explicitly to prevent circumvention. The justices expressed concern that failing to enforce these classifications effectively would render the notification ineffective and open to exploitation by other importers.