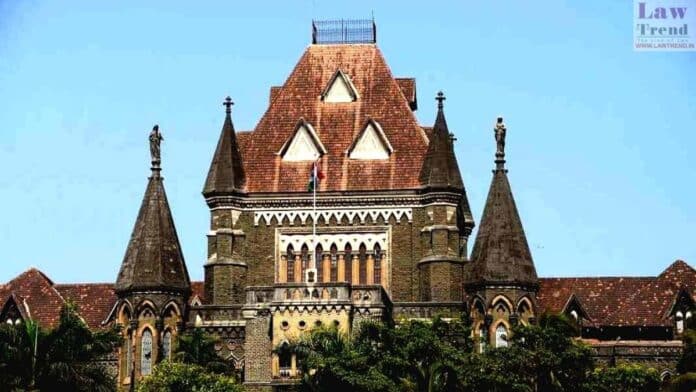

The Bombay High Court has recently confirmed the involvement of seven more parties in the ongoing National Spot Exchange Ltd (NSEL) payment default saga, highlighting the depth of alleged financial misconduct. This decision reinforces a lower court’s ruling to prosecute five directors from various financial institutions and two corporate entities.

The controversy first unraveled in 2013 when NSEL faced a massive payment crisis, impacting around 13,000 investors with losses totaling ₹5,574 crore. The newly implicated individuals and entities are accused of engaging in a criminal conspiracy, misleading investors, and generating falsified documentation to support illicit trading activities on the NSEL platform.

In 2023, the NSEL sought legal action against Nirmal Jain of India Infoline Commodities Ltd; Preeti Gupta and Rupkishore Bhutada from Anand Rathi Commodities Ltd; Shiney George and Manish Gupta of Geojit Comtrade Ltd; and the firms India Infoline Finance Ltd and Anand Rathi Financial Services Ltd. Following this application, the special court under the Maharashtra Protection of Interest of Depositors Act (MPID) recognized the gravity of the allegations and approved their addition as accused.

Challenging this decision, the accused approached the Bombay High Court, contesting the legitimacy of their inclusion in the case, particularly objecting to the basis that another co-accused had initiated their prosecution. However, the division bench comprising Justices Bharati Dangre and Manjusha Deshpande dismissed these appeals, stating that the court holds a responsibility to prosecute any individual linked to the offenses, regardless of the source of the accusation.

Justice Dangre emphasized, “If such a duty is cast upon the court, merely because it is one of the accused who has invited the attention of the court to this aspect, it cannot afford to refuse to discharge such duty.”