The Bombay High Court is set to deliberate on a significant tax dispute involving Skoda Auto Volkswagen India on February 17. The case revolves around a contentious $1.4 billion tax demand levied by Indian customs authorities, which has put the automobile giant in a challenging position.

This legal tussle traces back to allegations against the Volkswagen group, which, under the leadership of Skoda Auto Volkswagen India, is accused of misclassifying its automotive imports to reduce payable duties. Specifically, the company is charged with importing car parts as individual units rather than as components of “completely knocked down” (CKD) units. This method of import is crucial as CKD units typically attract a higher import duty of 30-35%, compared to the 5-15% duty applied to separately shipped components.

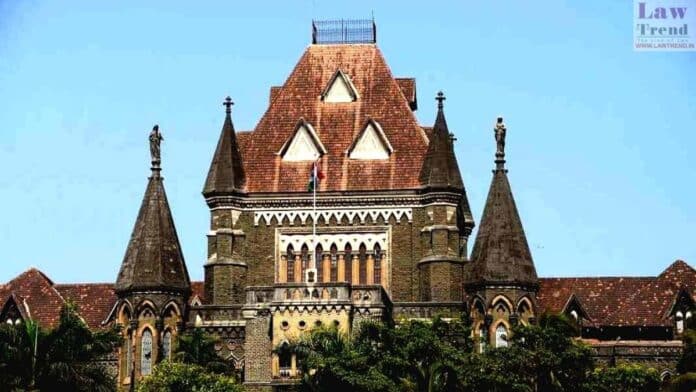

In response to a show-cause notice issued in September 2024 under the Customs Act, Skoda Volkswagen approached the Bombay High Court last month, challenging the customs authorities’ claim. The matter was brought forth for an urgent hearing by the company’s counsel before a division bench comprising Justices B P Colabawalla and Firdosh Pooniwalla.

The high stakes involved are evident, as Volkswagen, through its brands Audi, VW, and Skoda, has a substantial presence in the Indian market with models like Octavia, Superb, Kodiaq, Passat, Jetta, and Tiguan. These models are among those imported as CKD units and assembled in India, highlighting the scale and impact of the alleged duty evasion.

The backdrop of this dispute includes Volkswagen Group India’s strategic consolidation in 2019, where it merged its three passenger car subsidiaries into Skoda Auto Volkswagen India. This move aimed at enhancing efficiency and increasing market shares for both Volkswagen and Skoda by 2025, part of their broader India 2.0 project initiated with a 1 billion euros investment announced in July 2018.