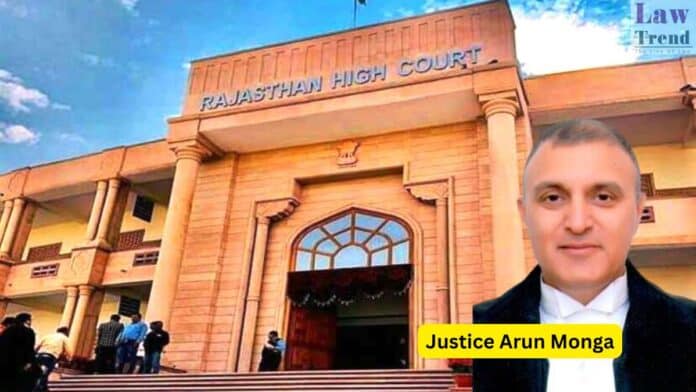

In a significant ruling, the Rajasthan High Court has held that the 20% deposit requirement under Section 148 of the Negotiable Instruments Act, 1881, may be waived if it jeopardizes an appellant’s right to a fair appeal. The decision came in Asha Devi v. Narayan Keer & Anr., a case involving a financially struggling woman

To Read More Please Subscribe to VIP Membership for Unlimited Access to All the Articles, Download Available Copies of Judgments/Order, Acess to Central/State Bare Acts, Advertisement Free Content, Access to More than 4000 Legal Drafts( Readymade Editable Formats of Suits, Petitions, Writs, Legal Notices, Divorce Petitions, 138 Notices, Bail Applications etc.) in Hindi and English.