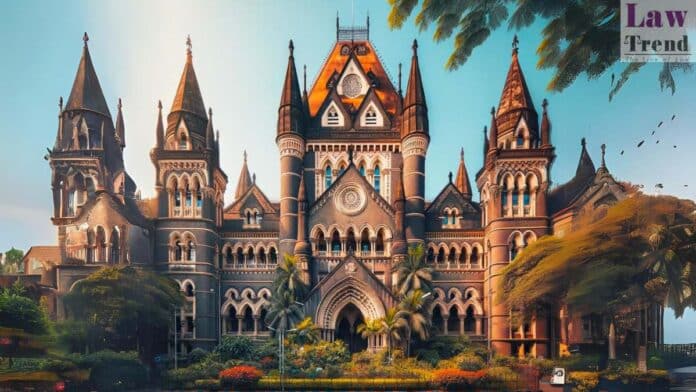

In a significant ruling, the Bombay High Court has quashed the reassessment proceedings initiated by the Income Tax Department against CapitalG LP, a United States-based limited partnership, citing the violation of the faceless assessment mechanism mandated under the Income Tax Act. The bench, comprising Justice G. S. Kulkarni and Justice Somasekhar Sundaresan, ruled in favor

To Read More Please Subscribe to VIP Membership for Unlimited Access to All the Articles, Download Available Copies of Judgments/Order, Acess to Central/State Bare Acts, Advertisement Free Content, Access to More than 4000 Legal Drafts( Readymade Editable Formats of Suits, Petitions, Writs, Legal Notices, Divorce Petitions, 138 Notices, Bail Applications etc.) in Hindi and English.