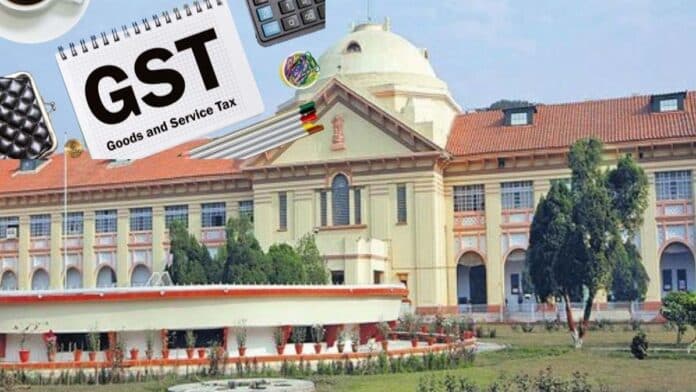

Recently, the Allahabad High Court stated that a typographical error in e-way bill without any material to substantiate the intention to evade tax cannot lead to imposition of penalty. The bench of Justice Shekhar B. Saraf was dealing with the application challenging the order passed by the Additional Commissioner Grade-2, Commercial Tax, Ghaziabad and the

To Read More Please Subscribe to VIP Membership for Unlimited Access to All the Articles, Download Available Copies of Judgments/Order, Acess to Central/State Bare Acts, Advertisement Free Content, Access to More than 4000 Legal Drafts( Readymade Editable Formats of Suits, Petitions, Writs, Legal Notices, Divorce Petitions, 138 Notices, Bail Applications etc.) in Hindi and English.